Why You Need A Part Time CFO For Your Small Business

It makes more sense to hire a part-time CFO for a small business while a controller accountant or head manager of finance normally handles the day-to-day financial demands of your small firms.

Perhaps you already have a business or are just making plans to start one. Starting a business is very challenging and undertaking. The entrepreneur has to be an expert in product development, analyzing market sales, marketing, and finances.

However, additional expertise via a third-party financial services provider to a part-time CFO will be required for transitional situations. It will become very difficult for someone who is very creative to focus efforts on strategic financial matters, this is where a part-time strategic CFO can be a great benefit to an entrepreneur or business owner.

In this article below, detailed information on part-time CFOs needed for businesses will be highlighted in addition to the reasons for these, how to hire a part-time CFO, and some other related information.

Who Is A Part-Time CFO?

Basically, A part-time CFO is a professional who will be in charge of your business or company’s administrative financial and risk management operations.

The basic job of a part-time CFO for small businesses is to assume the responsibilities of the chief financial officer and lend their financial expertise to a startup on a contractual basis.

In addition to this, part-time CFOs are also known as virtual CFOs or just fractional CFOs. They are not full-time company employees, only there to assist startups to tide over on a temporary basis.

CFOs are very good at documenting, thinking through, analyzing strategic plans, and also looking at the possibility of both downsides, and upsides and how we could react to them.

Nevertheless, a part-time Controller comes in and analyzes trends and the market, the cash flow that might result from certain strategies. This really adds quite a bit more value than perhaps an outsourced bookkeeper.

Why Do You Need A Part-Time CFO?

One of the things that entrepreneurs need to do is move away from an approach that is sort of seat-of-the-pants, the plan for a business within the head of the entrepreneur moves towards more of a formalized strategic plan.

However, this gets written down and all the details are sorted out including the strategic financial components and that is where a part-time strategic CFO can play a major role. You definitely need a part-time CFO for a lot of service and expertise, below is a list of reasons for this.

- Maintaining The Financial Aspects Of Your Business

- Finance And Risks Management

- Raising Capital For The Growth Of Your Business

- For The Reviews Of Customer Contracts

- Maximizing Sales Productivity

- Part-Time CFOs Saves You Time For performing Other Business Operations

Maintaining The Financial Aspects Of Your Business

At this point a part-time CFO can come in and solve those issues, allowing business owners to make better use of his or her time for other business activities. This is one of the reasons why you need to get a CFO.

Finance And Risks Management

CFOs are responsible for formulating a financial and operational strategy, and identifying, maintaining, and monitoring control systems to protect company assets.

Raising Capital For The Growth Of Your Business

If you are a small business owner, you need to realize that hiring a part-time CFO will save you the time of making plans to raise capital for your business. All of these will be carried out by the CFO alongside executing an evergreen strategy for financial growth.

The financial and strategic components of the company are well communicated with leading investors, bankers and others. To realize your goal you must have someone who can collaborate with your business team. This is why it’s therefore very important to have a part-time CFO for your business.

What Do You Look For In A Fractional CFO?

Leading a developing company necessitates a great deal of effort as your firm grows. You’ll find that you’ll need more financial and business skills. A company looking for a part-time CFO will benefit greatly from hiring someone who has dealt with and handled several financial problems.

Below are some basic requirements you need to look out for before hiring a part-time CFO for your small business.

- Must Be A CPA (Certified Public Accountant)

- Financial Modeling Experience

- Leadership And Management Skills

- Must Be Able To Set up Financial Reports Using Generally Accepted Accounting Principles

- Extensive Previous CFO-level Experience

- Self-discipline And Communication

Must Be A CPA (Certified Public Accountant)

There are lots of CFOs that are not a CPA, they may be an accountant or a bookkeeper, or they might just even have an MBA.

As a part-time CFO, it is required that I have rock-solid accounting. The first step in adding value is making sure your CFO has world-class accounting systems tools and procedures.

A well-written accounting policies procedures and internal control document that must be tailored to the CFO should be presented and updated quarterly.

System And Tools

Note that your CFOs need to have the tools and systems already in place before you hire them.

You definitely want to make sure they have tools built including a closing checklist. This is going to show the exact month of activity occurrence when it will occur, whoever is responsible for it and how it will be reviewed and reported to you (CEO).

Leadership And Management Skills

It is very important to study CFOs to check whether or not they have skills relating to leadership and management. These skills are essential for the successful outcome of your business.

Although, part-time CFO for smaller businesses is recommended as you will hardly find CFOs without any of the aforementioned skills.

How Can You Hire A Part-Time CFO For Your Small Business?

A cost-effective way to maintain your small business is to hire top talent and a part-time CFO for small businesses, who must be a team player and should be able to blend in with your staff and company culture. Go through the following procedures below on tips to hire a part-time CFO.

- Make a research on the internet for inquiries on Chief Financial Officers in your location.

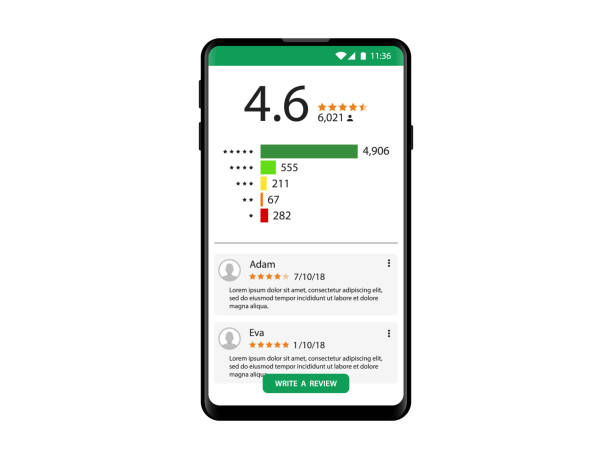

- The next step is to check out some client reviews of the CFOs you come across on the net. Reviews of the professionals will give you an idea of the person is willing to work with.

- If you are interested in the CFO you found on the internet, you can go ahead and schedule a meeting with him/her or give them a phone call.

Additionally, you can simply get references from friends or colleagues as they should be willing to share ideas of versatile CFOs.

Conclusion

Lastly, If you are in need of a professional that can evaluate your business, look for ways to improve margins, implement new ideas that would improve the alarm results of the business, and get back on track, you definitely need a part-time CFO for your small business in order to get the job done.